Please visit at:

http://www.freemarketeconomicsinastory.blogspot.com/

Austrian Economics in a Story

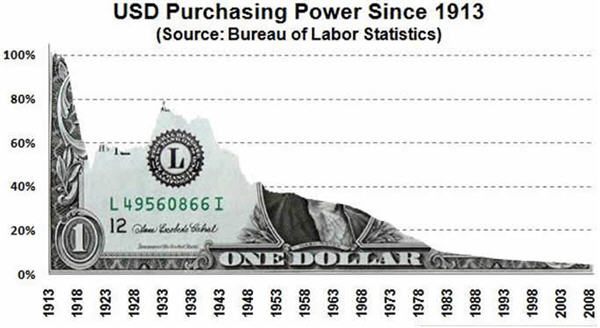

The Federal Reserve was created in 1913

The Federal Reserve was created in 1913

U.S. dollar no longer backed by gold since 1971

U.S. dollar no longer backed by gold since 1971

Sunday, June 13, 2010

Thursday, May 27, 2010

The "evil" price gouger

William Beckett was an opportunist, so it came as no surprise to anyone who knew him that William would find a way to try to profit off the impending large Hurricane as it swirled in the Gulf of Mexico.

William lived in Indiana, a 12 hour drive to any of the Gulf of Mexico states. He and his 2 sons rented the largest truck they could find. They took it to a warehouse store and bought as many case of bottled water as the store had. The truck was only half full so they went to several other stores and bought them all out as well. All in they were able to purchase 1100 cases of bottled water. William and his sons went back home and watched the TV to see where the hurricane would make landfall.

The storm was headed for the panhandle of Florida. As the men headed south on the highway William remembered the last time he had taken a similar trip. That hurricane suddenly had weakened so William turned his truck around mid way on his trip and tried to cut his losses. Luckily he was able to return most of the water, but he still lost almost a thousand dollars on the truck rental and gas. Despite the financial risks, William still thought it was worth it for him to take a chance again on this hurricane. He calculated he could sell the water for 2 to 3 times what he paid and possibly make a quick $10,000.

When the men were about half way through Alabama they checked into a motel to get some rest and wait out the worst of the storm. Throughout the night the motel was blasted by torrential rain and strong wind gusts. The hurricane had made land fall in Florida with winds of 130 miles per hour. According to news reports, it was still a moderate tropical storm as it passed over them during the night.

Several coastal communities in Florida were badly damaged. In the morning William and his boys set off to make their much anticipated profits. To their dismay, a large tree branch had broken the windshield of the truck. William cringed as he wondered how much he was going to have to pay have that replaced when he returned to Indiana.

When the men approached the storm ravaged areas they had to slow down and stop often. The damage was visible everywhere. Windows were broken. There was no power so the street lights were all out. Many of them had been blown down. Several times they had to back up and retrace their route when the road became impassable. They didn’t see many people outside so kept driving until they found a strip mall with a supermarket. By now it was early afternoon. The local residents had already cleaned out the store the day prior as news of the impending hurricane developed. The men parked their truck in the parking lot, pulled up the rear sliding door and waited.

It wasn’t long before a middle aged man drove into the parking lot. He was clearly distressed that the grocery store was closed and empty. He saw the truck and made his way over. William sold the man 5 cases at $20 each. Things were beginning to look up for the men. As the day wore on and word spread a crowd gathered. William and his boys had sold almost all the water and there were still dozens of people remaining. When it became apparent they men were running out of water the remaining crowd became agitated. William wondered how long it would take him to make another trip out of the storm zone for a fresh load of water. The group of people became louder. Someone called the police. Two squad cars arrived and the police officers approached the crowd. People were screaming, calling the men price gougers. Within a few minutes the police had arrested the three men. They took them to the local jail which hadn’t been too badly damaged.

There was no drinking water in the jail however, so after a long hot night the officers decided to let the men go. They would have to return for their court date and hefty fines the following month. If the men were lucky they would not have to spend any more time in jail. The men climbed into their damaged truck and made their way home. “Never again!!” William said as they drove off.

When they arrived back in Indiana, they watched news reports of the affected areas. Apparently the people were still unable to find any supplies. The stores were not yet restocked and no relief agencies had arrived. The reporter showed a line of volunteers bringing food and water to local collection areas in the surrounding states. They hoped to have the first truckload delivered by the end of the week.

William lived in Indiana, a 12 hour drive to any of the Gulf of Mexico states. He and his 2 sons rented the largest truck they could find. They took it to a warehouse store and bought as many case of bottled water as the store had. The truck was only half full so they went to several other stores and bought them all out as well. All in they were able to purchase 1100 cases of bottled water. William and his sons went back home and watched the TV to see where the hurricane would make landfall.

The storm was headed for the panhandle of Florida. As the men headed south on the highway William remembered the last time he had taken a similar trip. That hurricane suddenly had weakened so William turned his truck around mid way on his trip and tried to cut his losses. Luckily he was able to return most of the water, but he still lost almost a thousand dollars on the truck rental and gas. Despite the financial risks, William still thought it was worth it for him to take a chance again on this hurricane. He calculated he could sell the water for 2 to 3 times what he paid and possibly make a quick $10,000.

When the men were about half way through Alabama they checked into a motel to get some rest and wait out the worst of the storm. Throughout the night the motel was blasted by torrential rain and strong wind gusts. The hurricane had made land fall in Florida with winds of 130 miles per hour. According to news reports, it was still a moderate tropical storm as it passed over them during the night.

Several coastal communities in Florida were badly damaged. In the morning William and his boys set off to make their much anticipated profits. To their dismay, a large tree branch had broken the windshield of the truck. William cringed as he wondered how much he was going to have to pay have that replaced when he returned to Indiana.

When the men approached the storm ravaged areas they had to slow down and stop often. The damage was visible everywhere. Windows were broken. There was no power so the street lights were all out. Many of them had been blown down. Several times they had to back up and retrace their route when the road became impassable. They didn’t see many people outside so kept driving until they found a strip mall with a supermarket. By now it was early afternoon. The local residents had already cleaned out the store the day prior as news of the impending hurricane developed. The men parked their truck in the parking lot, pulled up the rear sliding door and waited.

It wasn’t long before a middle aged man drove into the parking lot. He was clearly distressed that the grocery store was closed and empty. He saw the truck and made his way over. William sold the man 5 cases at $20 each. Things were beginning to look up for the men. As the day wore on and word spread a crowd gathered. William and his boys had sold almost all the water and there were still dozens of people remaining. When it became apparent they men were running out of water the remaining crowd became agitated. William wondered how long it would take him to make another trip out of the storm zone for a fresh load of water. The group of people became louder. Someone called the police. Two squad cars arrived and the police officers approached the crowd. People were screaming, calling the men price gougers. Within a few minutes the police had arrested the three men. They took them to the local jail which hadn’t been too badly damaged.

There was no drinking water in the jail however, so after a long hot night the officers decided to let the men go. They would have to return for their court date and hefty fines the following month. If the men were lucky they would not have to spend any more time in jail. The men climbed into their damaged truck and made their way home. “Never again!!” William said as they drove off.

When they arrived back in Indiana, they watched news reports of the affected areas. Apparently the people were still unable to find any supplies. The stores were not yet restocked and no relief agencies had arrived. The reporter showed a line of volunteers bringing food and water to local collection areas in the surrounding states. They hoped to have the first truckload delivered by the end of the week.

Friday, May 21, 2010

Business cycles are caused by the Federal Reserve

The business cycle under the Federal Reserve:

1) The Fed lowers interest rates below what they would be on a free market.

2) Businesses borrow money for long term projects that previously hadn’t seemed profitable.

3) People and money flow into the sectors most influenced by the apparent boom.

4) The Fed begins a process of incrementally increasing interest rates at regular intervals.

5) Prices rise, often ending in a mania phase (examples: dot-com bubble, housing bubble)

6) A realization occurs that there is not sufficient actual savings to make all the projects profitable in those sectors affected by the boom.

7) Prices fall, unemployment rises, as the market tries to reallocate resources in ways that matches workers and capital into more useful projects.

8) The Fed again lowers interest rates below what they would be on a free market.

9) Money losing businesses are kept alive by borrowing to finance their day-to-day expenses. They hope for a return to higher prices in an attempt to unload inventory and return to profitability.

10) Resources and workers are encouraged to remain in the unprofitable post boom industries.

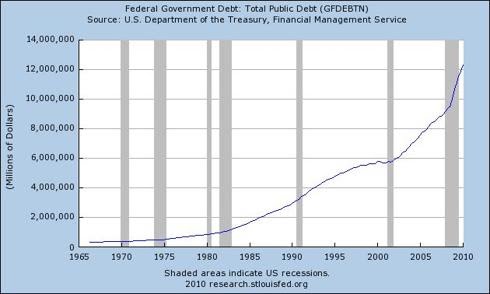

11) Servicing large debt loads becomes widespread.

12) New long-term business projects are evaluated based on the artificially low rates.

13) Return to #2 above and repeat the cycle, now with larger debts loads. This will continue with each successive cycle getting worse until either the debts default en masse in a deflationary depression or the currency collapses in a crack up boom hyperinflationary depression.

A Free market scenario alternative is possible as the recession in #7 begins:

8) Malinvestments are cleared from the system as those who made bad bets lose money. Those who risked the most money on ill-fated projects go bankrupt.

9) The assets of bankrupt firms are sold based on bankruptcy laws. Viable businesses reopen under new management.

10) Wage rates normalize across industries based on market conditions. Workers realign themselves into healthy industries.

11) People make business decisions, especially those concerning long-term projects, based on the correct market interest rate.

12) When the amount of savings increases, interest rates fall. When the amount of savings decreases, interest rates rise.

13) The free market interest rate allows businesses to correctly judge the viability of long-term projects by matching up cheap money with situations where projects will be profitable upon completion. The savings exists to purchase the products.

1) The Fed lowers interest rates below what they would be on a free market.

2) Businesses borrow money for long term projects that previously hadn’t seemed profitable.

3) People and money flow into the sectors most influenced by the apparent boom.

4) The Fed begins a process of incrementally increasing interest rates at regular intervals.

5) Prices rise, often ending in a mania phase (examples: dot-com bubble, housing bubble)

6) A realization occurs that there is not sufficient actual savings to make all the projects profitable in those sectors affected by the boom.

7) Prices fall, unemployment rises, as the market tries to reallocate resources in ways that matches workers and capital into more useful projects.

8) The Fed again lowers interest rates below what they would be on a free market.

9) Money losing businesses are kept alive by borrowing to finance their day-to-day expenses. They hope for a return to higher prices in an attempt to unload inventory and return to profitability.

10) Resources and workers are encouraged to remain in the unprofitable post boom industries.

11) Servicing large debt loads becomes widespread.

12) New long-term business projects are evaluated based on the artificially low rates.

13) Return to #2 above and repeat the cycle, now with larger debts loads. This will continue with each successive cycle getting worse until either the debts default en masse in a deflationary depression or the currency collapses in a crack up boom hyperinflationary depression.

A Free market scenario alternative is possible as the recession in #7 begins:

8) Malinvestments are cleared from the system as those who made bad bets lose money. Those who risked the most money on ill-fated projects go bankrupt.

9) The assets of bankrupt firms are sold based on bankruptcy laws. Viable businesses reopen under new management.

10) Wage rates normalize across industries based on market conditions. Workers realign themselves into healthy industries.

11) People make business decisions, especially those concerning long-term projects, based on the correct market interest rate.

12) When the amount of savings increases, interest rates fall. When the amount of savings decreases, interest rates rise.

13) The free market interest rate allows businesses to correctly judge the viability of long-term projects by matching up cheap money with situations where projects will be profitable upon completion. The savings exists to purchase the products.

Thursday, May 20, 2010

Economics on a Bike

Jim and Harry went on their bikes for a friendly 10 mile bike race. After they were well past the half way point Harry had a comfortable lead and could see Jim several hundred yards behind him. The two men were cruising along at a fast pace.

Suddenly Harry’s bike chain became dislodged. As he began to slow, he thought of his options. If he stopped to reload the chain onto the gears, Jim would surely catch up and pass him before he could get back up to speed. The prospect of wasting time off the bike and then having to pedal doubly fast to catch Jim again was an unpleasant one.

This was a new course for the men so they were unfamiliar with the terrain. As Harry rounded a turn in the road, he noticed that the road was now in what looked to be a long continuous down slope. Harry’s eyes perked up as he realized he was again gaining speed. Harry made the decision that he should stay on the bike in light of this new development. Harry coasted down the hill and lowered his profile so as not to let the wind slow him down. His lead over Jim was maintained

While Harry was at first apprehensive about not stopping to fix the bike chain, he was happy that as fate would have it, he was able to coast down the hill without having to stop. Harry figured he could always fix it later if the hill let up and he would be no worse off. Harry lowered his profile still more and heard the wind whip past his helmet.

Several minutes passed before Harry turned his head. To his surprise Jim was now only about 20 yards behind him. Of course, Harry muttered to himself as he realized that due to his pedaling Jim had entered the down turn at a higher speed before beginning the descent. Jim was gaining fast and it was clear he would soon overtake Harry. Harry’s mind raced as he wondered what to do next. He saw the finish line approaching and realized his fate was sealed.

This story is paralleling the burden of Harry's bike chain being dislodged with that of large amount of debts. The down slope reduces the burden of Harry's problem. Similarly lower interest rates reduce the burden of the debt load. In both cases the problems are not solved, only postponed. They look as if things have improved but in actuality nothing has been done correct the problems. It only masks it and eventually makes his problems worse.

Debt is a burden, whether owed by a person, company or country. It costs money to pay the interest on debt. When people make a rational decision to retrench and reduce their debt burden they emerge in a stronger financial position. Harry was burdened by his bike chain becoming dislodged. His life would have been much easier had he gotten off his bike to fix it and reentered the race in a strong situation with a fully functioning bike.

When the Fed lowers interest rates below their naturally occurring free market rate, they are encouraging people to continue along as if their debt burdens were not a problem. True enough the interest burdens are temporarily lessened but just as in the story above, the fix is illusory and temporary.

When interest rates are lowered artificially below their natural rate it sends a false signal to the market participants. This not only prevents a true lasting recovery from taking place, it also sows the seeds for the next boom mania period where projects will be started that are doomed to fail.

We have seen this occur twice already just in the past ten years. The Nasdaq dot com bubble burst, a historic period of malinvestent. Instead of allowing the market to respond efficiently to eliminate the bad businesses and debts, thus letting the successful companies thrive, the Fed lowered rates to 1%. The much needed recession upon which a lasting prosperity could occur was cut short. In its place, a new even larger boom period of malinvestment began. The housing bubble wreaked havoc on millions of people and cost trillions of dollars of losses. The mortgage and related securities melted down in fall 2008 with the infamous banking crisis as bad bets could no longer be ignored by the firms foolish enough to have engaged in them.

Instead of at last letting the recession finally come and clean the slate for all the poor decisions, the Treasury nationalized enormous companies and the Federal Reserves bailed out firms that should have failed by making them whole on their bad bets. Then on top of that the Fed lowered rates to close to 0%, which is where we still stand today. There will be no lasting period of prosperity with the Fed in charge. The best we can hope for is yet another bubble to distract everyone from their precarious debt situation.

Suddenly Harry’s bike chain became dislodged. As he began to slow, he thought of his options. If he stopped to reload the chain onto the gears, Jim would surely catch up and pass him before he could get back up to speed. The prospect of wasting time off the bike and then having to pedal doubly fast to catch Jim again was an unpleasant one.

This was a new course for the men so they were unfamiliar with the terrain. As Harry rounded a turn in the road, he noticed that the road was now in what looked to be a long continuous down slope. Harry’s eyes perked up as he realized he was again gaining speed. Harry made the decision that he should stay on the bike in light of this new development. Harry coasted down the hill and lowered his profile so as not to let the wind slow him down. His lead over Jim was maintained

While Harry was at first apprehensive about not stopping to fix the bike chain, he was happy that as fate would have it, he was able to coast down the hill without having to stop. Harry figured he could always fix it later if the hill let up and he would be no worse off. Harry lowered his profile still more and heard the wind whip past his helmet.

Several minutes passed before Harry turned his head. To his surprise Jim was now only about 20 yards behind him. Of course, Harry muttered to himself as he realized that due to his pedaling Jim had entered the down turn at a higher speed before beginning the descent. Jim was gaining fast and it was clear he would soon overtake Harry. Harry’s mind raced as he wondered what to do next. He saw the finish line approaching and realized his fate was sealed.

This story is paralleling the burden of Harry's bike chain being dislodged with that of large amount of debts. The down slope reduces the burden of Harry's problem. Similarly lower interest rates reduce the burden of the debt load. In both cases the problems are not solved, only postponed. They look as if things have improved but in actuality nothing has been done correct the problems. It only masks it and eventually makes his problems worse.

Debt is a burden, whether owed by a person, company or country. It costs money to pay the interest on debt. When people make a rational decision to retrench and reduce their debt burden they emerge in a stronger financial position. Harry was burdened by his bike chain becoming dislodged. His life would have been much easier had he gotten off his bike to fix it and reentered the race in a strong situation with a fully functioning bike.

When the Fed lowers interest rates below their naturally occurring free market rate, they are encouraging people to continue along as if their debt burdens were not a problem. True enough the interest burdens are temporarily lessened but just as in the story above, the fix is illusory and temporary.

When interest rates are lowered artificially below their natural rate it sends a false signal to the market participants. This not only prevents a true lasting recovery from taking place, it also sows the seeds for the next boom mania period where projects will be started that are doomed to fail.

We have seen this occur twice already just in the past ten years. The Nasdaq dot com bubble burst, a historic period of malinvestent. Instead of allowing the market to respond efficiently to eliminate the bad businesses and debts, thus letting the successful companies thrive, the Fed lowered rates to 1%. The much needed recession upon which a lasting prosperity could occur was cut short. In its place, a new even larger boom period of malinvestment began. The housing bubble wreaked havoc on millions of people and cost trillions of dollars of losses. The mortgage and related securities melted down in fall 2008 with the infamous banking crisis as bad bets could no longer be ignored by the firms foolish enough to have engaged in them.

Instead of at last letting the recession finally come and clean the slate for all the poor decisions, the Treasury nationalized enormous companies and the Federal Reserves bailed out firms that should have failed by making them whole on their bad bets. Then on top of that the Fed lowered rates to close to 0%, which is where we still stand today. There will be no lasting period of prosperity with the Fed in charge. The best we can hope for is yet another bubble to distract everyone from their precarious debt situation.

Subscribe to:

Posts (Atom)